NEWS

Happy Tax Freedom Day!

As of June 2024, this is out of date. Please refer to Tax Freedom Day 2024 for the updated statistics.

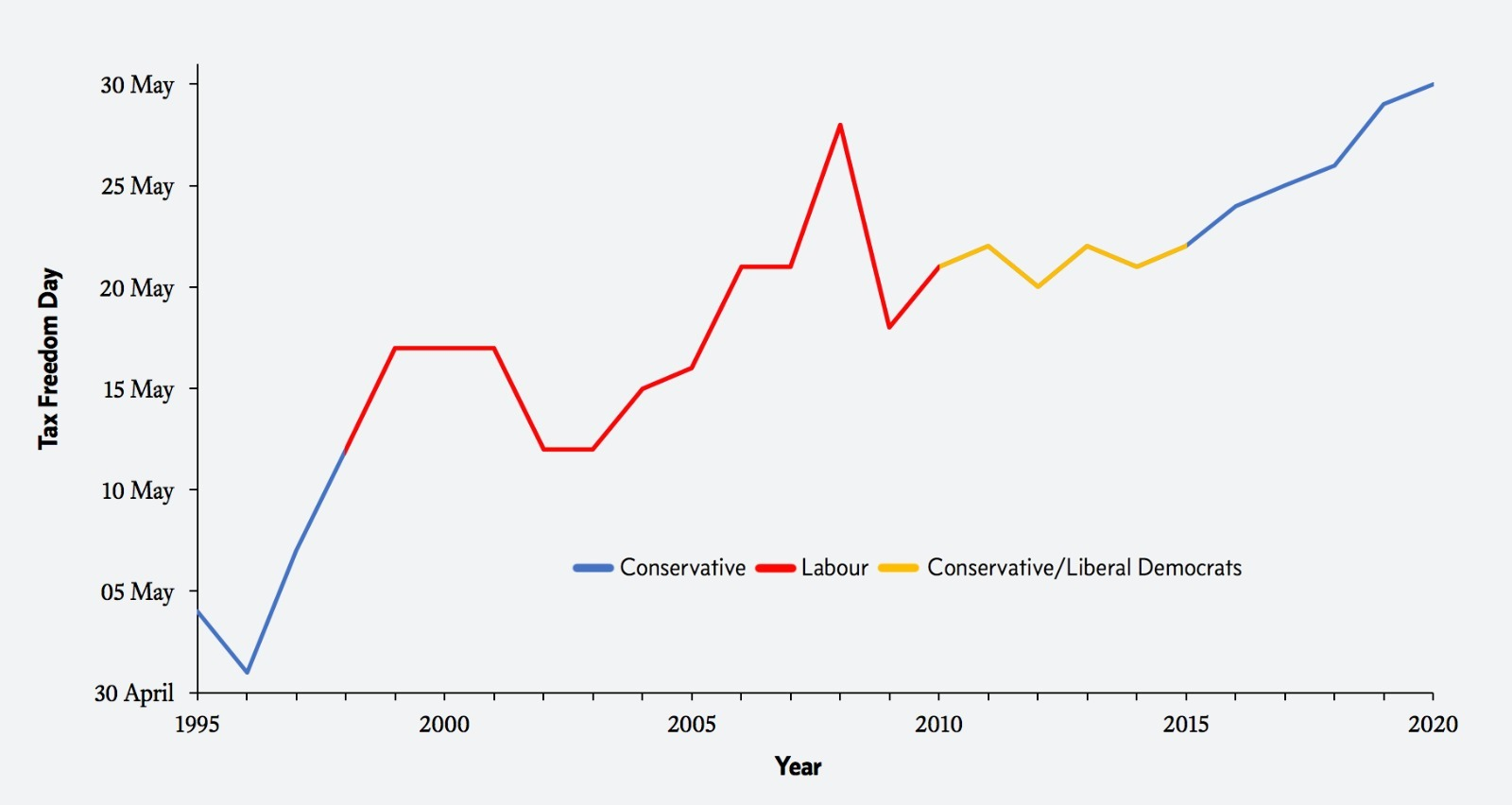

EVEN PRE-COVID TAX BURDEN HIGHER THAN AT ANY TIME SINCE 1995

Taxpayers worked 149 days for the Chancellor this year, today is the first day they start working for themselves

Tax Freedom Day falls on May 30th the latest it's been since 1995

Brits work 149 days of the year solely to pay taxes, 1 day more than last year, but as of today workers are earning for themselves

UK Taxpayers will fork out over £773 billion to the Treasury this year, 41.17% of net national income

But Tax Freedom Day is based on figures from before the economic and fiscal effects of COVID19 and the lockdown came into play

Cost of Government Day, which factors in borrowing as well taxes is the earliest it has been since 2008. The UK is successfully bringing down the deficit, but spending is still too high.

With tax demands at record highs, the way forward for growth at the end of lockdown cannot be to increase the burden on businesses but to reduce tax on the revenue generating private sector

Recent polling showed 72% think that the Government should reduce taxes after the lockdown to try to increase economic growth and jobs, with fewer than one-in-ten (8%) disagreeing with reduced taxes.

Tax Freedom Day is a measure of when Britons stop paying tax and start putting their earnings into their own pocket. For 2020 the Adam Smith Institute has estimated that every penny the average person earned for working up to and including May 29th went to the taxman—from May 30th onwards they are finally earning for themselves.

British taxpayers have worked a gruelling 149 days for the taxpayers this year. More than in any year under New Labour, and one day longer than last year. Britain’s tax burden is moving in the wrong direction.

Government tax choices fall on UK Taxpayers, this year they will fork out £773bn—representing 41.17% of net national income.

Unfortunately for Britons, this Tax Freedom Day cannot yet take into account the tax costs of measures taken to tackle COVID19. All borrowing is a form of taxation deferred and the hundreds of billions of pounds borrowed to tackle this viral threat will only begin to be borne in future years and as the government begins to unlock economic activity.

Tax Freedom Day remains over a month later than in the USA, and the UK has fallen behind Canada where their Tax Freedom day was on May 19 this year.

In April 2020 the Adam Smith Institute commissioned Survation between 15th - 16th April 2020 to undertake a nationally representative online poll of 1,001 UK adults (margin of error +-3.1%) to investigate the financial impact of the lockdown, views on developing an economic recovery and lockdown exit plan, and tax policy after the lockdown.

There is popular support for reducing taxes after the lockdown to help boost the economy and jobs. Younger cohorts are the most supportive of tax cuts after the lockdown. Almost three-quarters of respondents (72%) think that the Government should reduce taxes after the lockdown to try to increase economic growth and jobs, while fewer than one-in-ten (8%) disagree with reducing taxes.

Of those aged 18-34, two-in-five (44%) “strongly support” lower taxes after the lockdown, compared to just one-third (33%) of those over the age of 65.

The Adam Smith Institute singled out tax and regulatory changes in a recent report, Winning the Peace, that would boost growth post-lockdown and the pay packets of Britons right across the country:

The UK Government should respond to dire warnings on unemployment by immediately raising the threshold for employer’s National Insurance to £12,500.

Abolish the Factory Tax, by allowing for the immediate full write off on capital investments, to encourage business investment. ASI estimates show abolishing the factory tax would boost investment by 8.1 percent, and labour productivity by 3.54 percent (£2,214 per worker) in the long-run.

Governments across the UK should abolish stamp duty (in Scotland the Land and Buildings Transaction Tax). Britain’s most damaging tax, Stamp Duty destroys 75p of wealth for every pound raised.

Dr Eamonn Butler, Founder and Director of the Adam Smith Institute, said:

“Borrowing in a crisis is easy, making sure we balance the books and stop passing the buck to the next generation will be the hard bit. An economic recession and even the possibility of a depression cannot be ruled out. There will be calls for grand plans and spending like the clappers, but what we’ll actually need is the economic freedom to make choices for ourselves. We’ve all seen the damage in recent weeks of Whitehall deciding what’s good on our behalf.

“As we remove short-term restrictions we also need to remove the long-run burdens of government on transactions, investment, employment and our access to goods and services. We should not risk turning the last few months we’ve lost into a whole lost decade.”

Notes to editors:

For further comments or to arrange an interview, contact Matt Kilcoyne, Head of Communications, matt@adamsmith.org | 07904099599

The Adam Smith Institute is a free market, neoliberal think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

Raab right to extend visa offer to BNO passport holders

Responding to Dominic Raab’s announcement that the UK will extend visa rights to BNO passport holders if China does not suspend plans for new security laws in Hong Kong, Matt Kilcoyne, Deputy Director of the Adam Smith Institute, said:

“Raab is right to extend the offer of a visa. It will remind China that the UK and the rest of the free world will not sit idly by while inalienable rights, that we legally guarantee, are removed. But let's not delude ourselves, the Chinese Communist Party has no intention of swaying from its course.

”Britain needs now to be preparing to welcome those fleeing the scourge of communism for a new life in liberty and peace. The process of applying, getting a job, and starting that new life should be as easy as possible for as many as possible. All that come should have indefinite leave to remain from the first day of arrival. This is a test of the Prime Minister’s vision of a Global Britain. We welcome our fellow Britons with open arms from the get-go. Does Boris?”

For further comment or to arrange an interview, please contact him on 07904099599 or email matt@adamsmith.org

Slash tax and cut red tape to help Britain bounce back

A new paper from the neoliberal think tank the Adam Smith Institute argues that only boosting growth by cutting taxes and barriers to trade will ensure Britain’s economy bounces back from COVID19

Government is now loosening the public health restrictions that have undermined economic activity through a phased plan. The focus must now turn to how to successfully unfreeze the British economy.

As the lockdown eases, focus must shift from redistributing a shrinking economic pie to expanding the economy by embracing private sector entrepreneurship and innovation, and earned success to get people back to work.

Ongoing welfare should be broad-based and focused on helping individuals, not on bailouts to politically favoured companies.

Extraordinary emergency measures to “freeze” the economy that undermine long-run prosperity must not be allowed to become permanent.

The ASI has produced 30 policies to help boost transactions, investment, employment and access to goods and services

UK Government pandemic measures rightly focused on reducing the level of physical contact between people, while fiscal measures have focused on dialling down and switching off in parts for the duration of this crisis, with the corresponding logic being that when lockdown restrictions end that we can simply “switch the economy back on.” It is hoped that the economy will experience a “V-shape” recession.

The Adam Smith Institute argues that, while this would be ideal, it is by no means guaranteed with the risks of mass firm failure and an economic recession turning into a debt laden depression growing week by week.

This lockdown marks not only the first time countries have actively tried to freeze an economy for a long unplanned period of time, but also the first time trying to unfreeze. This will raise many unforeseen challenges.

The think tank argues that the UK must change attitude from economic lockdown to delivering on future prosperity now. In line with social distancing measures, this will mean withdrawing temporary corporate welfare measures, being flexible and not excessively prescriptive, and supporting people not failing businesses. Ultimately, they argue, it will be economic growth that delivers prosperity.

People who become jobless during a recession find it difficult to find future employment, as their skills and professional networks weaken. Young people, particularly those with higher skills, who enter the workforce during a recession have been found to have lower long-run lower earnings. This is what causes the “scarring” effect of lockdown.

In order to reduce the economic costs to wider society from the effects of the lockdown’s restrictions on private enterprise, the government must look now at how, as restrictions are lifted the government can boost:

Transactions — the ability of private individuals and firms to buy and sell;

Investment — the purchase of goods and services that to enable future growth;

Employment — the ability to enter contacts between employers and an employees; and

Access to goods and services — the availability and the liberty to consume products.

The free market think tanks says that the next stage of the recovery will require a new approach guided by following six principles:

Prosperity: The focus must shift from redistributing a shrinking economic pie to expanding the pie by embracing private sector entrepreneurship and innovation, and earned success to get people back to work.

Temporariness: Extraordinary emergency measures to “freeze” the economy that undermine long-run prosperity must not be allowed to become permanent.

Flexibility: Existing ways of thinking will not suffice, it is necessary to be adaptive to circumstance, pursue industry-specific measures and implement radical policies.

Common sense, not micro-management: The state should not seek to micromanage the reopening of the economy, but rather encourage businesses to adapt to new circumstances.

Supporting people, not businesses: Support should be broad-based and focused on helping individuals, not on bailouts to politically favoured companies.

Accepting failure: The economic structure and businesses must adapt to new circumstances; this will mean accepting some previously viable firms are no longer sustainable.

The free market think tank makes 30 recommendations including scrapping transactions taxes like Stamp Duty to restart the housing market, extending permitted development rights to ensure empty office space is turned into homes in inner city areas, reduced taxes on bringing in capital from overseas, scrapping investment taxes to encourage inward investment in manufacturing to rebalance the UK economy, and allowing Britain’s pubs and cafes to operate in the country’s parks.

With new figures out showing those claiming unemployment benefit has increased to 2.1m even with the furlough scheme, the think tank says employment taxes should be scrapped with the employers’ National Insurance threshold raised to £12,500 (employers currently pay 13.8% on every pound an employee earns over £7,488, with no cap).

While the UK is better placed than many economies with more rigid labour markets and investment environments, recovery is by no means guaranteed. Private enterprises need stronger trading conditions to begin recouping revenue lost during the lockdown and to do this, the authors argue, British enterprises will need a concerted campaign by the government to reduce red tape and slash taxes reducing economic activity.

Matthew Kilcoyne, Deputy Director of Adam Smith Institute and co-author of the paper, says:

“If there’s ever been a moment to be bold, now is that time. British businesses have been held back from generating revenue but have been taking on debt throughout the lockdown. As we remove short-term restrictions we also need to remove the long-run burdens of government on transactions, investment, employment and our access to goods and services. Only by freeing the economy up will Boris be able to ensure that the country bounces back.”

Matthew Lesh, Head of Research at the Adam Smith Institute and co-author of the paper, says:

“The Government must now focus on how to unfreeze the economy and a return to prosperity. This will be no easy task. We have never tried to freeze an economy before in response to a pandemic, and nor have we tried to unfreeze one. To do so successfully will mean unleashing Britain's entrepreneurs and innovators with a radical agenda of tax and red tape cuts.”

Notes to editors:

For further comments or to arrange an interview, contact Matt Kilcoyne: matt@adamsmith.org | 07904 099599.

The Adam Smith Institute is a free market, neoliberal think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

Whither the economists while the economy withers under COVID19 lockdown?

With the release of the details of the make-up of the groups advising the government over the lockdown, it is now clear there is a sincere lack of economic expertise as our financial future teeters on the brink. The Adam Smith Institute’s Matt Kilcoyne calls on the government to engage now with economists:

“SAGE includes epidemiologists, psychologists, statisticians, environmental and adolescent scientists, sociologists, and hygiene experts. It does not, however, include a single macro or micro-economist.

“The lockdown is having a huge impact on our lives and livelihoods. Our wellbeing is intrinsically linked to our economic prosperity. Millions of jobs are on the line. Thousands of businesses are on the verge of collapse.

“It is essential that Government policy is based on a wide array of perspectives — but to exclude mainstream economics is a blindspot of exceptional proportions. It leaves gaps in ideas and solutions at a time when we cannot afford any mistakes to be made.”

For further comment or to arrange an interview, please contact him on 07904099599 or email matt@adamsmith.org

Media contact:

emily@adamsmith.org

Media phone: 07584778207

Archive

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- January 2021

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- September 2013

- August 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

- March 2008

- February 2008

- November 2007

- October 2007

- September 2007

- May 2007

- April 2007