NEWS

Applying VAT to Independent School Fees Could Cost As Much As £1.6 Billion

A leading think-tank has warned that applying VAT to independent school fees could actually cost, rather than raise, money, and harm underprivileged children.

A new report by the Adam Smith Institute finds that applying VAT on independent school fees could raise no money at all;

In a less optimistic scenario, it could end up costing £1.6 billion;

The report also finds that the policy could counter-intuitively harm other children by creating a mass exodus to the already overwhelmed state system, intensifying competition for the country’s best state and grammar schools;

It could also reduce bursary and scholarship opportunities for talented youngsters.

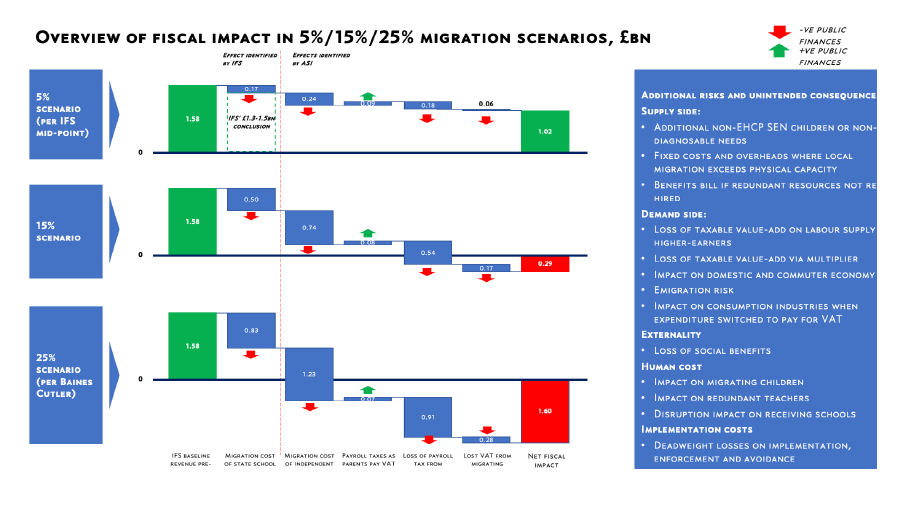

A new report by the Adam Smith Institute (ASI) highlights that the IFS’ findings that applying VAT to independent school fees will raise £1.3-£1.5 billion is based on evidence they themselves acknowledge to be ‘thin’ and ‘sparse.’ Under the IFS’ optimistic scenario, only a limited number of parents will no longer be able to afford fees, and will move their children to the state sector.

But the ASI’s research shows that there’s a reasonable chance that many more children will have to migrate to state school.

The report’s author, Maxwell Marlow, has calculated that every parent who earns money, pays tax at a 40% rate, and sends their child to an independent school, generates £28,000 every year for the Exchequer.

On the other hand, if VAT were to be applied, it could actually end up costing money. The ASI’s report looked at many different economic effects that the tax could have, including schools closing down, and teachers and parents leaving the workforce. It found that, in the IFS’ highly optimistic scenario in which 3-7% of children left for the state sector, it could raise a net £1.02 billion. Somewhere between 10-15%, it could raise no money at all. In a 25% migration scenario, which other research has shown may be a possible outcome, it could actually cost the Exchequer £1.6 billion.

The Adam Smith Institute outlines a number of other damaging consequences levying VAT on school fees could have for society and the economy including:

State schools could be even more overwhelmed - We do not know, and cannot know, where exactly in the country children will be leaving for the state sector. There are significant concerns about the ability of local authorities and schools to plan for these unpredictable outcomes.

Teachers and support staff could lose their jobs- 71% of school fees are spent on staff costs- if schools have to make cuts, they will most likely have to make staff redundant or cut their pay. Under the IFS’ optimistic scenario where 5% of children migrate to the state sector, we could (for example) expect 5,150 teachers to be made redundant.

It could counterintuitively have a negative effect on social mobility- If lots of children are financially pushed out of their independent schools, this could intensify competition for the country’s best state and grammar schools, reduce opportunities for talented and less-well off pupils, and drive up local house prices near these schools. If independent schools have to cut costs, this could mean that they reduce bursary and scholarship opportunities.

The ASI further notes that, in 2015, Greece applied a 23% VAT charge on independent school fees. Many of the things the ASI warns about in its paper actually happened- schools closed, teachers were made redundant, and the state sector was overwhelmed and faced huge teacher shortages.

Maxwell Marlow, Director of Research at the Adam Smith Institute, and report author, said:

“Britain's independent schools are good for the economy- taxpaying parents who send their children to one are removing extra costs and burdens from the state sector, and are contributing to public finances.

But applying VAT to school fees puts all this at risk, and counter-intuitively may not raise any money at all. In fact, this might actually cost taxpayers.

Our new report shows that, not only is there a chance it won’t raise money for state schools, it could harm underprivileged children by further over-whelming the already struggling state sector, reducing bursary and scholarship opportunities for talented youngsters, and pushing others out of popular state and grammar schools. And we risk staff redundancies and the closure of small, local independent schools who cannot absorb the costs.

Greece is already suffering the numerous economic and social consequences of applying VAT to school fees we warn about in this paper. We urge policymakers to exercise caution."

-ENDS-

Notes to editors:

For further comments or to arrange an interview, contact Emily Fielder, emily@adamsmith.org | 0758 477 8207.

Maxwell Marlow is the Director of Research at the Adam Smith Institute.

The Adam Smith Institute is a free market think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

Crypto CEO joins the Adam Smith Institute to head up their new Future Markets Policy Unit

Oliver Linch will join ASI Senior Fellows to promote the UK’s thinking in Fintech, AI and Emerging Technologies

The Adam Smith Institute, one of the world’s leading domestic policy think tanks, has launched a new Policy Unit to build on its leading work on the technologies of the future.

Former financial regulatory lawyer and Bittrex Global CEO Oliver Linch will be leading the ASI’s new policy division as a Senior Consultant. He brings a wealth of experience and expertise, having advised major investment banks, exchanges and leading institutions on regulatory matters across the UK, EMEA and North America.

He is a strong advocate of exploring the overlap between traditional finance and fintech — especially digital assets — and the way that they can work together to bring the lessons of substantive and comprehensive regulation into these exciting new sectors.

Oliver will be working alongside existing ASI Senior Fellows, digital policy and strategy consultant Dominique Lanzaksi, senior technology lawyer Preston J. Byrne, and US hedge fund co-founder Vuk Vukovic.

The ASI’s previous work in the fintech, artificial intelligence and emerging technologies policy space has included making the case for gene editing; an optimistic outlook on the future of AI and employment; a system of property rights on the moon, and the UK’s regulation of cryptocurrency.

James Lawson, Chairman of the Adam Smith Institute, said:

“The Adam Smith Institute has long been at the forefront of research into future markets and new technologies, including in health, transport, finance, and the very way we work - and how it can make our everyday lives better.

This new policy unit, with its combined decades of experience, will build on our existing body of research, promoting a positive and evidence-led approach in order to help the UK’s finance industry, public services, and private sector become more innovative, dynamic and effective.

I’m delighted to welcome Oliver Linch to the team as our Senior Consultant, whose phenomenal expertise will be of great value as he leads this important work.”

Commenting on his appointment, Oliver Linch, Senior Consultant to the Adam Smith Institute, added:

“Having long been called upon by colleagues, peers, and the media regarding matters of legal and regulatory policy across the fintech and emerging technologies space, I am delighted to be putting my expertise into practice at the ASI. Together, we aim to transform the way that the UK government thinks about some of the most innovative technologies currently at our disposal — everything from crypto to artificial intelligence. The UK currently stands at the forefront of the emerging technology landscape and, in this role, I hope to shape what the legislation around these innovations looks like.”

-ENDS-

For further comment on this release, or for expert comment from members of our Future Markets Policy Unit, please contact emily@adamsmith.org | 0758 477 8207.

Oliver Linch began his legal career with a leading global law firm, after which he became Chief Executive Officer and General Counsel of Bittrex Global, the global cryptocurrency exchange. He has over a decade of experience as a financial regulatory lawyer, having advised major investment banks, exchanges, and leading institutions on regulatory matters across the UK, EMEA, and North America. As part of one of the world’s top-ranking law firms, he specialised in various areas of financial regulatory advisory work, such as financial market infrastructure, payment services, and special economic zone and legislative drafting.

Dominique Lazanski is a digital policy and strategy freelance consultant, and has spent many years working in the Internet industry with many of those years working in Silicon Valley. She holds degrees from Cornell University and the London School of Economics and PHD from the University of Bath. She is a postdoctoral fellow at the University of Pittsburgh.

Preston J Byrne is a dual-qualified US and English Lawyer, partner with the digital commerce group in the Washington D.C. office of an international law firm and an adjunct professor of law at Antonin Scalia Law School at George Mason University. Preston writes on a range of subjects including housing and planning law, the security state, freedom of expression and cryptocurrency. He was the lead author of ‘Burning Down the House,’ the ASI’s policy paper opposing the Help to Buy mortgage subsidy programme, and is the author of ‘Sense and Sensitivity: Restoring Free Speech in the United Kingdom,’ a proposal for the repeal of numerous censorial law in the United Kingdom.

Vuk Vukovic is the Chief Investment Officer and co-founder of Oraclum Capital, a U.S. hedge fund. He was previously a lecturer at the Department of Economics, Zagreb School of Economics and Management. He holds a PHD in Political Economy from the University of Oxford, a Master’s degree from the London School of Economics and a BA in economics from the University of Zagreb, from which he graduated Magna Cum Laude. He authored the ASI report ‘Unburdening Enterprise: Reducing Regulation for Small and Medium Businesses.’

The Adam Smith Institute responds to the Spring Budget

Commenting on the Spring budget, Director of Research of the Adam Smith Institute, Maxwell Marlow, said:

“It’s encouraging that the Government understands the overwhelming need to cut taxes from the current record high, and the benefits that doing so brings to individuals, families and businesses. The Adam Smith Institute welcomes the cut to National Insurance, as well as the Chancellor’s commitment to even greater tax cuts in the future. Ideally, these would be both soon and include the abolition of entire taxes, like the immoral death tax, and even scrapping National Insurance itself. This would end the farce of double taxation on income by merging income tax and National Insurance for good.

“It’s also good to hear the Treasury has been listening to the Adam Smith Institute’s calls to further broaden full expensing to leased equipment, such as vans, diggers, and the kit we use to build Britain.

“The move towards working out child benefits by households, rather than by individuals, will end an unfair penalty on parents, and make it easier for Brits to have the number of children they want. In the meantime, raising the childcare threshold support to £80,000 is a good stop-gap.

“The planned public sector productivity drive for the NHS, especially by embracing AI, is going to be transformational, but it should be extended across the entire public sector.

“To really unlock the United Kingdom’s potential, the Government must now turn to serious supply side reforms, most importantly by allowing new houses to be built for current and future generations, giving the families of the future a place to call their own.”

-ENDS-

Notes to editors:

For further comment, or to arrange an interview, please contact emily@adamsmith.org | +44 7584778207

The Adam Smith Institute is a free market think tank based in London. It advocates classically liberal public policies to create a richer, freer world.

Media contact:

emily@adamsmith.org

Media phone: 07584778207

Archive

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- January 2021

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- September 2013

- August 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- April 2008

- March 2008

- February 2008

- November 2007

- October 2007

- September 2007

- May 2007

- April 2007